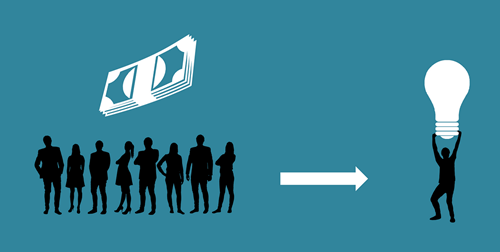

In an age where collaboration is on the rise, it’s not surprising that some are looking to find an alternative source of funding for their home or business purchase. Crowdfunding has been a successful way to fund various projects and business propositions, but it seems that some have found a way to make it work when purchasing property. The only question is, where’s the catch?

It’s no secret that crowdfunding may cut into the banking industry’s bottom line. And yet, some people are highly successful when it comes to utilizing it to secure their properties. How do they do it? Diligence and strategy.

Each donation by patron, if the funds are to be used immediately, is considered a gift. These gifts require letters stating that the funds don’t have to be paid back and are, indeed, a gift.

If you only have a few people donating to your crowdfunding campaign, that should be apiece of cake. However, if you have multiple donors, you might want to start checking them off one-by-one as they give until you’ve secured letters from all of those willing to send them to you.

If you run into anyone who isn’t willing to write the letter, is unresponsive, or you simply have time to wait on your purchase, you can put the funds from your crowdfunding adventure into a different account, and leave them alone. After a few months, the funds will have aged and may no longer need a letter.

The success rate is still iffy on securing funding through crowdfunding sources, however. The biggest hurdle is whether your lender will approve this unconventional method of down-payment.

Most crowdfunding requests usually has a story or mission attached to them. Some ask for the money to help their parents out of the rent cycle because they’re retiring, while others might be looking to open a new type of coffee shop and need a little extra to get things up and running. No matter the reason, you’re selling your story, but will folks buy it?

If you choose to go the crowdfunding route, you have to remember that the people funding you need a reason to fund you. You’ll have to give them the perfect story and reasoning or you’re going to end up flat and without funding. Some find this task incredibly daunting, while others are silver-tongued pros. Either way you slice it, crowdfunding is about marketing and storytelling.

If you decide to go the crowdfunding route, be sure to do ample research, line your ducks up and ensure that you’re ready for the journey. If it seems like it’s a little too much but you still want to find an alternative method of funding, chat with your real estate agent. There’s a plethora of options available, and we’d love to help you find the right one.